VAT is charged at each step of the ‘supply chain’. End consumers generally bear the VAT cost while registered businesses collect and account for the tax, in a way acting as a tax collector on behalf of the Federal Tax Authority.

As a supplier, you must register for VAT if your taxable turnover (which includes zero-rated supplies) exceeds Dh375,000 in a 12-month period, or if you expect your taxable turnover (which includes zero-rated supplies) to exceed Dh375,000 in the next 30 days.

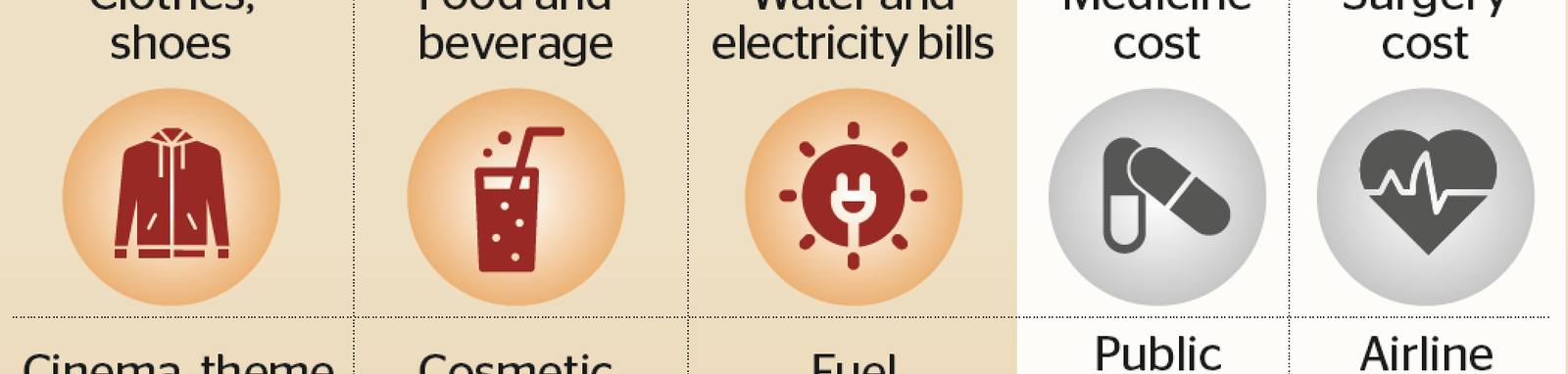

Exempt supplies are listed in Article 46 of the Federal Decree-Law no. (8) of 2017 on Value Added Tax, such as:

- Financial services including life insurance and reinsurance of life insurance as well as financial services that are not conducted for an explicit fee, discount, commission, rebate or similar type of consideration.

- Residential buildings, other than the residential buildings which are specifically zero-rated.

- Bare land.

- Local passenger transport.

- Healthcare